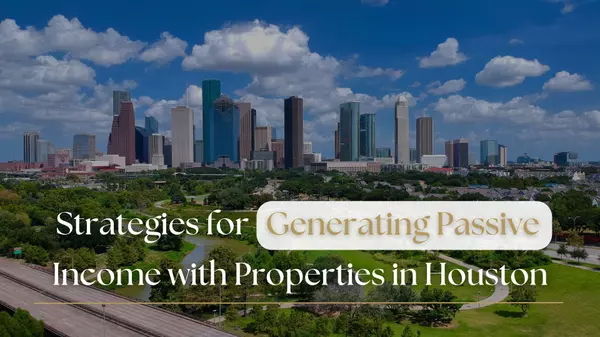

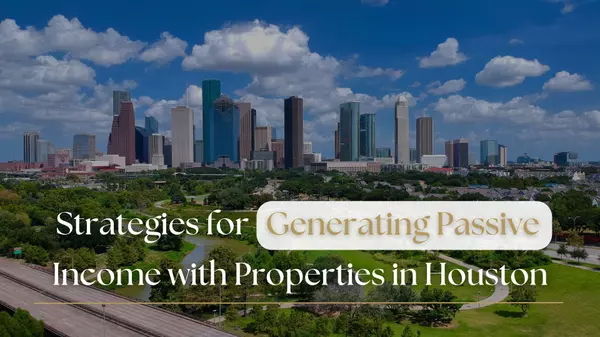

Strategies for Generating Passive Income with Properties in Houston

Houston, with its booming economy and growing population, is a prime market for real estate investors looking to generate passive income. From rental properties to short-term vacation stays, the opportunities are vast. Whether you're a seasoned investor or just starting, understanding the best strat

Real Estate Investment in Houston for Foreigners: A Complete Guide

Houston is one of the fastest-growing cities in the United States, and with its diverse economy, it is an ideal destination for foreign investors interested in real estate. From residential properties to commercial opportunities, Houston offers attractive investment returns. This complete guide will

The Best Areas to Invest in Commercial Properties in Houston

Houston, Texas, is one of the largest and most dynamic cities in the U.S., offering a robust economy, a strategic location, and diverse industries. As a thriving hub for energy, healthcare, technology, and transportation, it presents lucrative opportunities for commercial real estate investors. If y

Categories

Recent Posts